COMPANY REGISTRATION IN SHANGHAI

Shanghai, the cosmopolitan and vibrant city of China, offers numerous opportunities for businesses to thrive. If you are considering starting a company in Shanghai, it is essential to understand the process and requirements for company registration. In this article, we will guide you through the steps involved in company registration in Shanghai.

1. Choose a Company Name: The first step in registering a company in Shanghai is to choose a suitable name for your business. The name should comply with the rules and regulations set by the Chinese government. It is advisable to consult with a professional service provider or legal advisor to ensure that your chosen name meets all requirements.

2. Business Scope and Structure: Determine the scope and structure of your business. Shanghai offers various forms of business entities, such as Wholly Foreign Owned Enterprise (WFOE), Joint Venture (JV), Representative Offices, and more. Each type has its advantages and requirements, so carefully consider the nature of your business and choose the most appropriate structure.

3. Capital Requirements: Determine the registered capital for your company. The amount of registered capital will depend on the business scope and structure. Shanghai has relaxed the capital requirements for many industries, but it is still essential to have a reasonable amount of capital to support your business operations.

4. Documentation: Prepare the necessary documents for company registration, including:

– Articles of Association: This document outlines the company’s purpose, structure, and internal regulations.

– Proof of Identity: Provide identification documents of the company’s legal representatives and shareholders.

– Lease Agreement: If you plan to operate from a physical location, you will need a lease agreement for your registered office. Or we can help you to find the Nation Development Zone.

5. Registration Process: Submit the required documents to the relevant authorities for company registration. The process typically involves several government departments, including the Administration for Market Regulation (SAMR), Tax Bureau, and Statistics Bureau. It is advisable to engage a professional service provider familiar with the local regulations to assist you with the registration process.

6. Licensing and Permits: Depending on the nature of your business, you may need to obtain specific licenses and permits. For example, if you plan to operate in a regulated industry such as finance or healthcare, you will need to comply with industry-specific regulations and obtain the necessary licenses.

7. Tax Registration: After obtaining the business license, you must register for various taxes, such as Value Added Tax (VAT), Corporate Income Tax, and Social Security contributions. It is essential to understand and comply with the relevant tax laws and regulations.

8. Bank Account Opening: Open a corporate bank account with a local bank in Shanghai. This will facilitate your business transactions and ensure compliance with financial regulations.

9. Ongoing Compliance: Once your company is registered, it is crucial to comply with the ongoing reporting and compliance obligations. This includes filing annual financial statements, renewing licenses and permits, and fulfilling tax obligations.

10. Professional Assistance: Engaging a professional service provider or a business consultancy firm can simplify the company registration process. They have the knowledge and expertise to guide you through the complexities of Shanghai’s regulations and ensure a smooth registration process.

In conclusion, starting a company in Shanghai offers exciting opportunities for entrepreneurs. However, the process of company registration can be complex and requires careful consideration of various factors. By following the steps outlined in this article and seeking professional assistance, you can successfully navigate the registration process and establish your business in Shanghai.

Choose GWBMA, choose its expertise with high efficiency, and start your business in China today!

FOREIGN COMPANY REGISTRATION PROCESS

Application for Business License 3 in 1

After taking name approval, we draft a Articles of association for your company. We need Incorporation application report, Certificate of incorporation of overseas investor certified by Chinese Embassy, Standards forms, etc.

E-invoice

The company will officially start fully using digital Electronic invoice (E-invoice) on August 1, 2023, and will no longer issue paper VAT special invoices or VAT ordinary invoice.

Company Stamps

Company stamp, Financial stamp and Legal person's stamp.

Go to the Chinese Embassy for temporary work Visa Z

Usually a work visa is a single entry, the duration of stay in it is 000, which means that the duration is determined by the temporary residence permit that you receive after entering to China.

Apply for Work Permit

Apply online the Work Permit in the Shanghai SAFEA (State Administration of Foreign Experts Affairs).

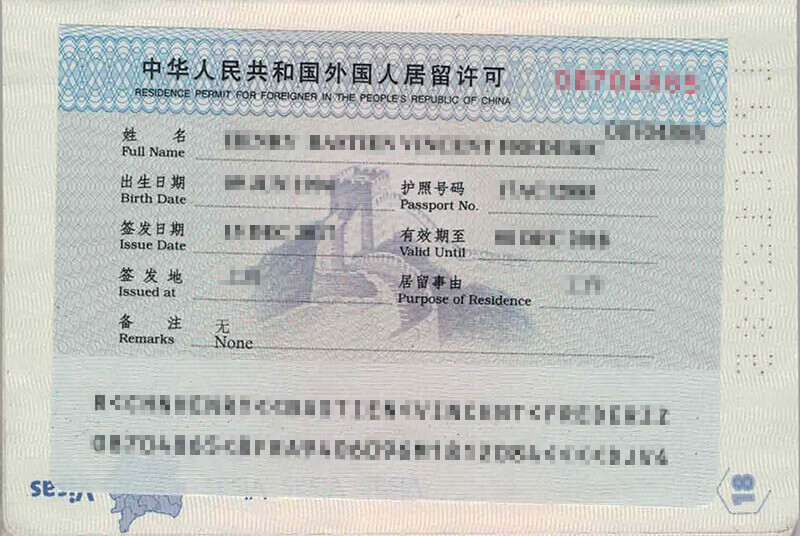

Apply Residence permit for work

Apply the Residence Permit in Exit-Entry Administration Department of Shanghai Public Security Bureau.